Behind Closed Doors: The Dirty Secret of Regulatory Capture

- Caveman

- Dec 2, 2024

- 4 min read

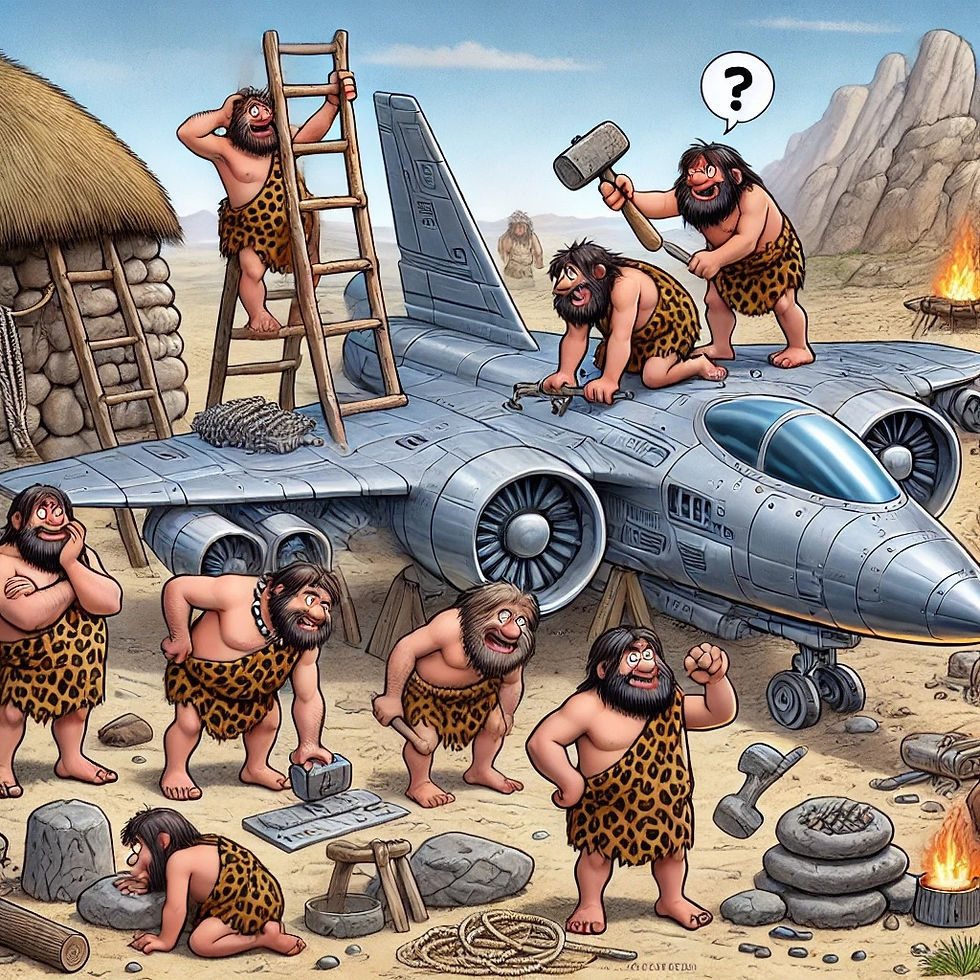

In the grand chessboard of politics and industry, there’s a move so subtle yet so powerful that it reshapes entire markets, consolidates power, and leaves the average person scrambling to keep up. It’s called regulatory capture—a sanitized term for what’s essentially legalized bribery.

At its core, it’s a tale as old as civilization: money changes hands, favors are granted, and the public is left holding the short end of the stick.

What is Regulatory Capture?

Regulatory capture happens when the referees (government regulators) start playing for the team they’re supposed to oversee (big corporations). Instead of protecting public interest, regulators end up safeguarding the profits of the industry giants, often at the expense of innovation, competition, and fairness.

Here’s the kicker: while the term sounds academic, the reality is straightforward—it’s bribery in a suit and tie.

Bribery 2.0: A Modern Playbook

Let’s not mince words. Regulatory capture thrives because the system is designed to normalize influence-peddling under the guise of legal frameworks.

Here’s how the game works:

Lobbying: The Front Door Bribe

Corporations spend billions hiring lobbyists to cozy up to lawmakers. Their job? Shape regulations to benefit their bosses.

The result? Policies that are supposedly for the "public good" but conveniently crush small competitors while propping up the big players.

Campaign Contributions: Politicians on Retainer

Industries pour money into political campaigns, essentially buying loyalty. When the candidate wins, they “repay” the favor with watered-down laws or lax enforcement.

Need proof? Look no further than the financial industry’s ability to derail meaningful banking reform post-2008, thanks to a steady flow of political donations.

The Revolving Door: Future Bribes Secured

Regulators frequently move between government jobs and high-paying private-sector gigs in the industries they once regulated.

Why go hard on a company today when it might offer you a seven-figure salary tomorrow?

Historical Highlights: How the Game Began in the U.S.

Regulatory capture in the U.S. has been part of the playbook since the 19th century. Here are some standout cases:

The Railroads (1800s): The federal government handed out massive land grants and subsidies to railroad companies, giving them enormous power. In return, these companies bribed congressmen (literally) to overlook corruption, as seen in the infamous Crédit Mobilier scandal of 1872.

Standard Oil (Late 1800s): John D. Rockefeller’s empire wielded financial influence to keep lawmakers off its back. Despite the passage of the Sherman Antitrust Act in 1890, enforcement was weak due to the cozy relationship between regulators and trusts.

The Meatpacking Industry (Early 1900s): Large companies like Swift and Armour influenced the USDA to enforce regulations that hurt smaller competitors while allowing the giants to thrive.

Bribery in Plain Sight: Modern Examples

Fast-forward to today, and regulatory capture isn’t just alive—it’s thriving. Here’s how it manifests:

Big Tech: Companies like Amazon, Google, and Facebook spend billions lobbying against antitrust reforms while crafting data privacy laws they can easily comply with but which crush smaller startups.

Big Pharma: Pharmaceutical companies fund FDA programs and lobby Congress, resulting in fast-tracked drug approvals and minimal price controls.

Big Banks: After the 2008 financial crisis, major banks were bailed out and faced weak regulations under the Dodd-Frank Act, thanks to their lobbying efforts.

Why It Works: The System Rewards Corruption

Let’s be blunt: regulatory capture persists because it benefits those at the top. Corporations get a monopoly-like grip on their industries, regulators get cushy jobs, and politicians get reelected with industry money.

The losers? Everyone else.

Here’s why the system doesn’t change:

Money Talks: Campaign finance laws allow industries to fund political careers openly.

Complexity Hides Corruption: Regulations are intentionally complicated, making it hard for the public to see who benefits.

Public Perception is Manipulated: Laws and regulations are marketed as "necessary for safety" or "good for consumers," even when they primarily serve industry interests.

The Cycle of Capture

Regulatory capture isn’t a one-off event; it’s a cycle:

The Rise of Industry: An industry grows powerful enough to catch the government’s attention.

The Bargain: The government offers regulation—often welcomed by industry leaders because it protects them from competition.

The Capture: Regulators and industries grow intertwined, creating rules that benefit incumbents while shutting out challengers.

The Public Pays: Higher prices, less innovation, and limited choices.

What Can Be Done?

Breaking the cycle of regulatory capture requires a multi-pronged approach:

Transparency: Make lobbying activities and campaign contributions fully public and easily accessible.

Revolving Door Reforms: Limit the ability of regulators to move into industry jobs immediately after leaving public service.

Stronger Antitrust Enforcement: Break up monopolies and encourage competition.

Public Awareness: Educate people on how regulatory capture works so they can demand accountability.

Final Thoughts: A Rigged Game

Regulatory capture may sound like an abstract policy issue, but its impact is painfully real. It’s why your healthcare costs are sky-high, why new startups struggle to survive, and why your personal data feels less secure than ever.

At the end of the day, the system runs on a simple formula: He who pays, gets his way. Whether it’s the railroads of the 1800s or Big Tech today, the story is always the same.

The question is, will we keep letting the game play us—or will we start rewriting the rules?

%20Clear_edited.png)

Comments